Today we’re discussing my biggest travel hacking mistakes and how you can avoid them.

If you’re new to travel hacking and want to start somewhere other than all the not-so-fun mistakes, check out my other articles here:

- How to Start Travel Hacking

- Best Travel Credit Cards for Miles

- Is Capital One VentureOne a Good Travel Credit Card?

- Discover It Miles Credit Card: Honest Review [2022]

- Capital One VentureOne vs. Discover It Miles [2022]

And now to the mistakes…

- Never revisiting the perks of my existing travel cards

- Missing out on points stacking to earn more points with my everyday purchases

- Being closed minded to working credit cards with annuals fees to my benefit

- Not having a good strategy for hitting minimum spend amounts

- Having a false understanding of how travel hacking actually affects credit score

Avoiding these travel hacking mistakes will save you time and money in the long run.

Mistake 1: Not Revisiting Travel Credit Card Perks

When I learned about travel hacking from my brother in 2015, I signed up for the two credit cards he suggested.

He was a detailed and avid researcher and my own deep dive concluded that the two entry-level cards he recommended were indeed at the top of the list for most ‘experts’ at the time.

The Capital One VentureOne and Discover It Miles cards still occupy top tier spots on many ‘best no annual fee’ travel credit card lists today.

After signing up, getting approved, and reading over the perks and points accrual rates of each credit card, I came up with a strategy based on those perks and ran with it.

I ran with this for like 6 years.

It’s kind of embarrassing to admit to be honest.

It was only until recently when I started telling family and friends about travel hacking and refreshing myself on the credit cards I used (to write these blog posts, of course) that I realized that my strategy all these years for those first two cards wasn’t the best one.

PSA: credit card perks, incentives, and company partnerships change over time.

Are we shocked?

No.

Reading through the complex terms of use and perks of a credit card can get a little confusing, but it’s important to pay attention to detail.

I’d recommend spending a couple of days reading various reviews and revisiting the actual company perks for a second pass before deciding on a strategy.

Moral of the story is, revisiting the perks of the travel cards you already have can save you more money traveling.

My Initial Strategy Failure

In the beginning, I thought the best approach would be to use the Discover It Miles card for the first year to cash in on the unlimited matching bonus and then switch over to the Capital One VentureOne card after the first year.

This was my approach because, at the time, the Discover It Miles card had a points accrual rate of 1 point per dollar and the Capital One VentureOne card had an accrual rate of 1.25 points per dollar.

Or so I thought.

I honestly don’t know if I misread the points accrual rate 6 years ago, or if the Discover It Miles card initially had a 1 point per dollar accrual rate that increased it to 1.5 somewhere in the years between 2015 and now.

I can’t find any obscure article to support this theory though, so I believe it was a case of me misreading the points rate and never revisting it.

How to Avoid This

Ground Work

When deciding what credit card to sign up for, do some reading.

Obviously, the perks list on the actual credit card site is a must.

But reading the thoughts of travel hacking sites and personal finance bloggers can also provide money-saving tips, helpful perspectives, and trial and error examples that can help you settle on an informed travel hacking strategy.

I’d recommend spending a week or more assessing the information you dig up before choosing a credit card.

This is simply best practice.

If you have someone you can trust personally who can recommend a card to you, even better.

I know this is what helped me get started.

It is still necessary to look into the cards yourself to make sure the perks are appropriate for you, however.

Always do your own ground work.

Make it a Habit to Review the Perks of the Card

Once you’ve signed up, make it a habit to review the perks and programs of your chosen card(s).

How you choose to implement this habit is up to you.

- You can integrate a credit card perks review into your month-end budget or spending review.

- You can schedule quarterly reviews. (This would be plenty to catch most basic perks updates and also not very time consuming).

Get Granular

Revisit the perks and articles about your card.

It’s amazing what making a second pass on information with a fresh perspective can do.

Read credit card promotional emails.

I know it’s annoying to think about actually opening the emails from your credit card company, but it pays to do so.

The emails are written to be scanned and offer a quick look at the current deals and give you leads on what can potentially work for your travel goals.

While these marketing emails are meant to push a certain agenda or partnership, it is a good way to stay tuned into the bonuses and perk updates your card has to offer.

Mistake 2: Not Taking Advantage of Credit Card Portals

Double dipping and benefit stacking is the true art of travel hacking.

It’s what makes travel hacking 3 dimensional.

This is something that I missed out on for years.

It wasn’t until recently when my husband and I started listening to the Bigger Pockets Money podcast that we came across an interview with Lee Huffman.

He claimed to have a PhD in travel hacking.

The fact that he took his family of four (including his mother-in-law) to Paris for free was a good indicator he knew what he was doing. Oh, and he also flew first class.

While he admittedly made most of his points back in the heyday of travel hacking by exploiting loopholes in the fine print of the deals and offers of the time (which sadly barely exist anymore), he did bring my attention to some non-loop holes that can boost my points accrual rate.

Enter, my revelation to points stacking.

Turns out, simply buying things you were going to buy anyway through a specific travel card portal is a way to cash in on 2-15 extra points per dollar spent.

This is in addition to your regular points per dollar rate.

Easy math takes the regular 1.5 – 1.8 points earned per dollar up to right under 17 points per dollar spent.

Bonus!

And this is all for buying things you already planned to buy through the credit card company portal.

No extra cost to you.

It’s worth mentioning that you’re not going to find Target, Walmart, or Amazon on these lists of compatible merchants in the credit card portals, but you will be able to buy direct from smaller companies or more fringe companies that offer the same products for usually the exact same price.

I was over here playing 2D travel hacking this whole time not realizing that I could be doubling up on points by making sure to buy things I was already going to buy through credit card portals.

Real Life Example

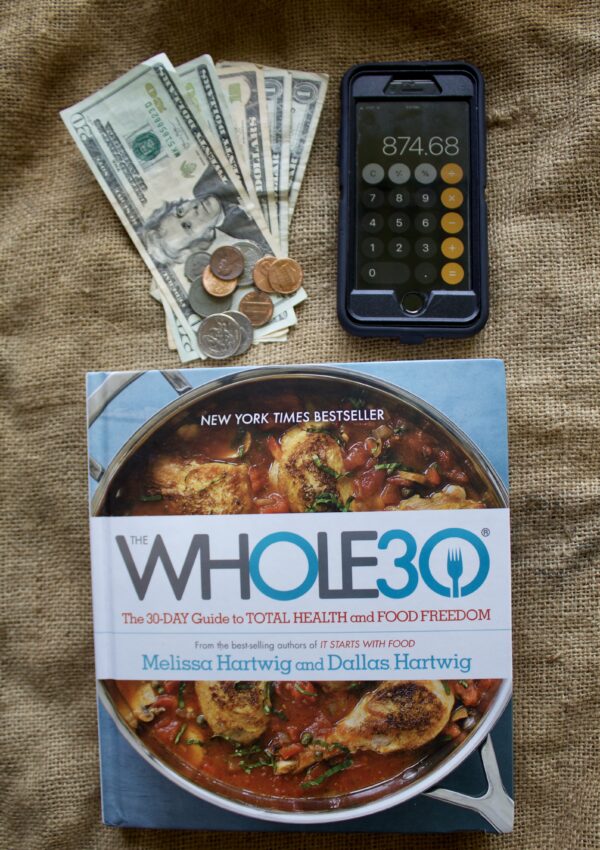

As a recent example, during my Whole30 month, I wanted to try Thrive Market.

Before signing up for my 30 day free trial, I hopped on Southwest.com’s shopping portal.

I was pleased to find a whole list of stores with varying points offered from 2 points per dollar all the way to 15.

Thrive Market had a limited time points offer for 15 rapid rewards points per dollar spent, plus the regular 1.8 points per dollar I get on a regular basis.

My free trial and first grocery order gave me right under 1,000 rapid rewards points to put towards my next flight, plus my regular credit card points.

I like to call this method ‘checking multiple boxes’, and I just had to realize there was a way to do it with my travel cards.

To be fair, Thrive Market was offering quite a high deal. Most other deals were 2-7 extra points.

This was a case of one of their highest offers aligning with something I already intended to try out during my Whole30 month.

Mistake 3: Not Understanding How to Use Higher Rewards Cards with Annual Fees

I signed up for a few entry-level cards and never looked back.

While I saved a few thousand dollars over the years, that was over a long period of time.

Travel hacking is more about saving a couple of thousand dollars EVERY year.

Getting paid-for flights, free hotels, exclusive upgrades you don’t have to pay for.

That sort of thing.

In this episode of Sarah’s mistakes, it was more a matter of me not understanding how to use the higher rewards cards in a way that made sense for me.

At the beginning I didn’t have the spending rate or bills of a household.

It didn’t make sense to get the higher rewards cards and try to spend 4-5 thousand dollars in a couple of months for those sign on bonuses. It just wasn’t feasible.

Once I moved past that point and got married, got into real estate, land projects, maybe a few preparedness gear-ups here or there, I had an increased spending rate.

At that point I just didn’t have an open mind towards how to work around annual fees.

In my mind, it was a hard stop for annual fees. Signing up for something that would take money out of my pocket every year never sounded like a smart move to me.

It felt like it would eventually catch up to my initial savings with the sign on bonus.

This was all based on a lack of understanding.

I was pretty ignorant of how things actually worked.

Most annual fee cards are $95 or less. Also, most of those cards offer one of two things:

- A free night or amt. towards a hotel room a year ($50 – $250 value)

- A nice anniversary bonus that offsets the fee

These perks built in can-count-on benefits, bring down the annual fee to a more negligible amount.

Plus, you also have to remember you’re accruing points at a higher rate.

Realizing the annual fees were less of a big deal than I thought has been a game changer for me. There were some other realizations that went into this as well, but we’ll get to those.

Mistake 4: Not Knowing How to Hit Minimum Spends without ‘Wasting’ Money or Over Spending

One of the biggest tips I picked up from podcasts and reading sites like The Points Guy, was how to hit minimum spends for the higher level rewards cards.

As an example, I signed up for two cards that offered higher sign on bonuses than regular yuppie cards in the past half year or so.

The Chase Sapphire Preferred card – 80,000 bonus points after spending $4,000 in 3 months.

The Southwest Rapid Rewards – 75,000 bonus points and Companion Pass after spending $5,000 in 3 months.

There are two main ways we made sure to hit these minimum spends wisely.

- Saved some of our bigger purchases for when we got the card.

- Paying our bills in advance.

It’s kind of a no-brainer to save larger purchases for getting a new card, but when I thought about just our monthly bills and expenses, it was a little difficult to see how hitting these minimum spends would be feasible.

I used to have a job that allowed me to buy things for work and then get reimbursed for. This was a dream. I could spend my company’s money through my travel card, get the bonus points, and not have to actually pay for anything.

I don’t have that lovely benefit anymore, sadly. So, we had to save some of our other planned purchases that were a little on the larger side for when our new cards came in the mail.

Think, new tires, food storage, self defense items.

All areas of our life we planned to spend more on, that we were reaching a point where we were actually going to purchase those types of items.

The second way is less intuitive, for me at least. I didn’t think about paying our car insurance for 6 months each and our internet bill for the entire year when I first started.

But, turns out, paying your fixed bills for an extended period of time is an easy way to hit your minimum spend without having to think up something to buy that you don’t need.

The sad part is, you cannot pay your mortgage with a credit card. There are companies out there that claim they can facilitate the process, but the percentage of the transaction fee is not worth the points you’ll earn.

Mistake 5: Not Understanding How Travel Hacking Affects Credit Score

I also used to ascribe to the notion that canceling a credit card was a big no, no and that signing up for a ton and potentially not keeping them all would have a huge impact on my credit score.

Turns out, I was wrong about this one too.

Does it affect your credit score?

Absolutely.

Is it detrimental?

No.

Especially if you have the good to excellent credit score usually needed to qualify for these types of rewards cards.

While I’m clearly not an expert, from the reading and research I’ve done, the amount of credit score fluctuation is negligible for someone who has a solid history of paying debt and not carrying over interest.

That is, someone who’s credit utilization ratio is at or below 30%.

I’d encourage you to read more about how travel hacking affects credit score, and make sure to consult with a financial advisor if you are unsure if signing up for a credit card and canceling it will be a detrimental move for you.

For instance, buying a home is not the time to jack around with your credit score. At all.

Points fluctuation will affect what interest rate you’ll be locked into for 30 years.

Looking to rent, also not the best time to jack around at all with your credit score.

If you’re in a stable living situation and know you have the time, organization, and discipline to stay on top of managing multiple credit cards, by all means, do sign up for those extreme bonus cards.

Just know when you cancel in a year or so, you may have a little credit score hiccup.

Also, keep in mind, credit card companies are in the business of making money and will change the rules and regulations over time. So, back to Mistake 1, always try to stay on top of the new, new.

Don’t neglect understanding how to safely cancel a credit card just because it’s unknown.

Like I did.

To play the game well, you’ve got to get in there and understand the rules.

Read deep and wide.

Educate yourself on what possibilities are out there, preferably with a specific destination in mind, and walk out that plan.

The major theme with these common mistakes is not making time to continue to learn about using credit cards as the tools they are.

Also, not ever stopping to challenge, look into, or confirm my preconceived ideas.