This post will attempt to explain compound interest simply. Plus, we’ll also look at some of my favorite free compound interest calculators you can use to get inspired to invest right now.

What is Compound Interest in Simple Words?

Put simply, compound interest is when you earn money on the money that your money earns in an investment or bank account. At the core, compound interest is earning interest on interest.

A simple definition of compound interest from Merriam-Webster Dictionary: to pay (interest) on both the accrued interest and the principal. (Emphasis added.)

The accrued interest is what you earn from your initial investment.

The principal is another way of saying the money you initially invested.

What is Compound Interest? An Example

For example, say you put $100 dollars in an investment account offering a 4% interest rate that compounds monthly. If you only contributed $10 every month for 15 years following your initial investment of $100, you’d have approximately $785.09 after 5 years ($85.09 earnings), $1,621.58 after 10 years ($321.58 earnings), and $2,642.94 after 15 years ($742.94 earnings).

See the chart below, courtesy of investor.gov.

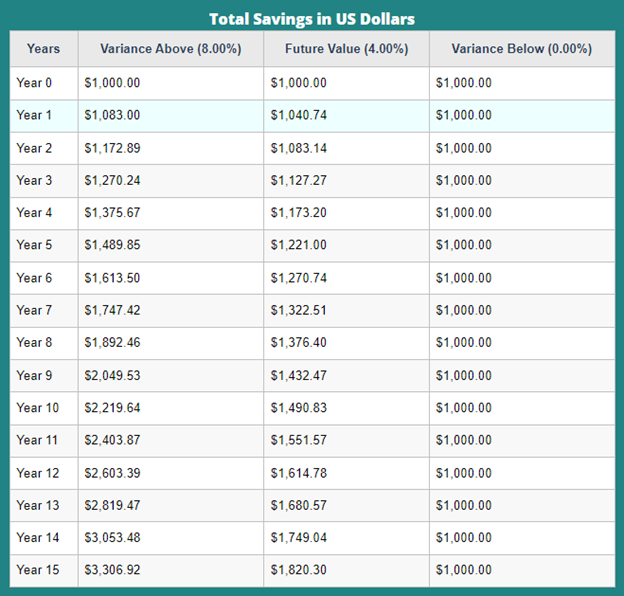

Using compound interest, you turned $1,900 dollars into $2,642.94 without having to do much other than automate $10 savings every month. You can also choose to drop a lump sum into an account and never contribute again, but this method grows a lot slower. With our $100 example, you’d only earn $82.03 after 15 years without making any additional contributions.

On the other hand, if you decided to drop a larger initial investment of $1,000 into the account and never contributed to it again, you’d actually surpass the first scenario of $100 + $10 a month for 15 years. You’d earn $820.30 on $1,000 after 15 years without ever adding to it.

As you can see, it is important to start investing early. The passing of time allows your initial investment to snowball for longer and earn more money. The compounding effect is what makes your cash multiply exponentially because the interest that your money earns is put to “work” for you immediately.

Keep in mind that in this example the 4% interest rate never fluctuated, which is uncommon. Many investment accounts and high-interest bank accounts do fluctuate over time based on the overall market.

Best Compound Interest Calculators You Can Use for Free

The compound interest calculation is not the simplest formula on the planet. It involves:

- the principal

- interest

- number of compounding periods per year

- the total number of years for the investment or loan.

Needless to say, it isn’t as straightforward as multiplying your initial investment (principal) by the interest rate and doing that for each of the following months or years. For an in-depth review of the formula, check out this Study article.

That formula is why I prefer to use compound interest calculators. Many financial websites have their own compound interest calculators that you can use for free.

Investor.gov has an excellent calculator that also shows a table with interest accrued and a column tracking your contributions.

And my other favorite compound interest calculator is from NerdWallet which has a sleek interface and easy-to-read graphs.

Not every calculator gets exactly the same numbers, but they do get you really close.

Use these calculators to get inspired to find a good investment fund or bank account and start growing your money exponentially using compound interest.

How Do I Get Compound Interest?

And now for the million-dollar question (somewhat literally). How exactly do you cash in on compound interest? For starters, you have to find a place to invest your money.

Some typical investment options include:

- 401(k)s

- Roth IRAs

- Index Funds

This is by no means an exhaustive list and I’m not going to pretend to be able to explain the differences between these options (that’s a post for another day). This is a good high-level list to get you pointed in the right direction, however.

A Roth IRA is the typical example cited in the “lattes are a waste of money” conversation. An Individual retirement account (IRA) has the potential to be opened early enough and sustained a 12% overall rate of growth, your daily latte money could very well turn into a million dollars in 40+ years.

The caveat of the actual sustained average percentage likely not being 12%, but even half a million would be nice to have for your future self, especially if you plan to retire.

Roth IRA Calculator

A Roth IRA calculator is another fun tool you can use to get inspired to start investing. You’ll have a few questions to answer from an income, age, and tax standpoint, but it will allow you to get a little projection of what opening a Roth IRA could turn into for you down the road.

This particular NerdWallet calculator has an average rate of return set to 6%. Keep in mind, Roth IRA return percentages can fluctuate, but the average is typically around 6% – 10%, based on decades of data. This is the type of calculation referenced by Suze Oreman in my, Why I Buy $5 Lattes post.

High APY Bank Accounts

Another option to make your money work for you is finding a bank account that offers a high Annual Percent Yield (APY). Some banks offer a compound interest opportunity that also happens to be more liquid than some of the other investment vehicles we’ve talked about.

With a 401(k) or Roth IRA, you’d have to wait until a certain age to withdraw your money tax-free, which is the main advantage of having these types of accounts in the first place. With a bank option, you aren’t bound to this rule, which makes your money in a much more liquid state.

The bank account that we like to use is Live Oak. The current APY is 4%. This is a great way for us to make money on our existing savings while we wait to find a good real estate deal. Seeing the interest payments every month is a boost to our morale and the money we have set aside for real estate.

Bottom Line

After seeing the benefits of compound interest, you may be ready to cut a monthly or daily habit of yours that doesn’t mean that much to you in favor of putting that amount away in an investment account.

When choosing the amount to save every week/month, make sure it is a sustainable choice. Also, automating the amount you decide to save is a choice that can’t be beaten. This way, you never see the money in your regular account. It is just automatically put to work for you and you never miss it.

And lastly, a word of encouragement. Starting to invest early in life has a ton of benefits, there’s no denying that, but that doesn’t mean it is too late to start now. Please be gracious with yourself and don’t fall into the trap of moving on without taking action right now because you perceive it as “too late”.

Know what you know now and run with that knowledge. It’s going to take some time and research and ownership, but at the end of the day, it is your responsibility, and I’d argue your God-given responsibility, to manage the things you’ve been given to the best of your ability. I truly believe that. And please know that I’m telling that to myself as I write this.