What Does it Mean to Pay Yourself First?

Pay yourself first is a phrase in personal finance that essentially means prioritizing investing in yourself first before your bills and the things you want.

While that may feel unrealistic with the cost of living and all your financial obligations, it is realistic to say you can’t ignore your future self and long-term financial position forever.

Even saving $25 or $50 every week right now is an excellent step to paying yourself first. This can turn into an emergency fund and a nest egg that can help you continue to live well down the road.

What ‘Pay Yourself First’ Doesn’t Mean

The concept of paying yourself first doesn’t mean you can shirk your responsibility to pay your bills or pay off your debts. It also doesn’t mean spending all your extra cash on buying new things you want in the name of self-care.

Instead of seeing what’s left at the end of each paycheck, start by setting aside money for your future self first. This means, before you pay your basic bills (needs) and buy that new pair of jeans (wants), you pay yourself first by putting money aside for your long-term financial stability.

A great way to do this is to set up an automatic deposit into a savings account. This ‘set it and forget it’ method makes saving money easy to maintain and surprisingly unnoticeable. The power in the concept of paying yourself first is the realization that saving money is really paying your future self.

How Do You Pay Yourself First?

It’s a simple concept, but it can be a struggle to know the practical steps to take when getting started with paying yourself first.

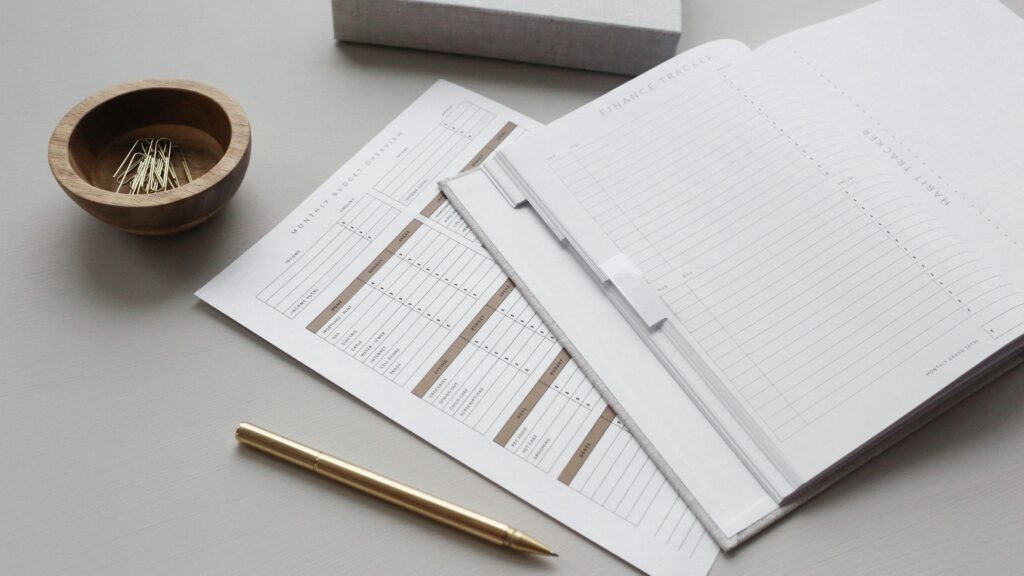

On a basic level, it’s a matter of reviewing your finances, taking stock of your salary, figuring out a savings goal, and setting up automatic systems to help you reach those goals on auto-pilot.

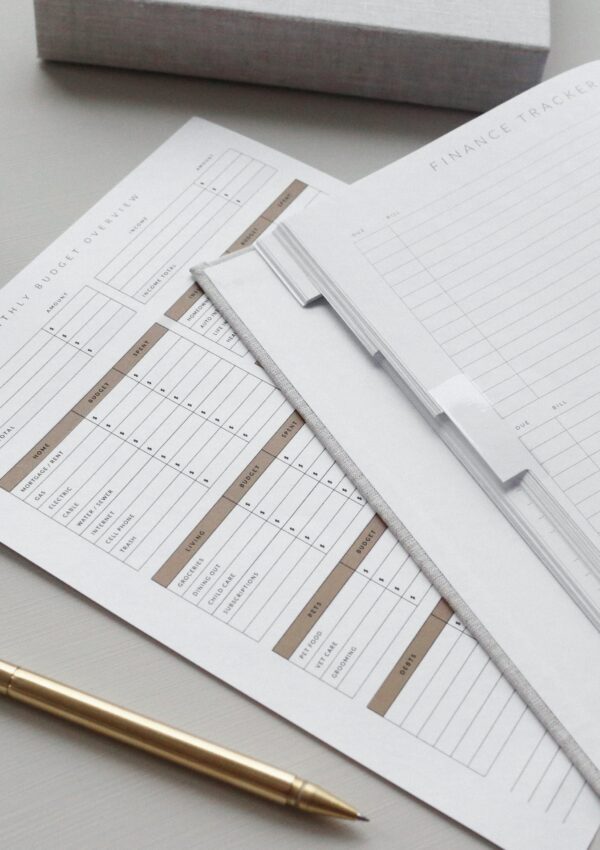

Review Your Spending

Take a look at your budget and spending. An easy way to do this is to get a pen and paper and write down all your bills and expenses. Or a spreadsheet, whatever works.

- How much money is left after every paycheck? This number will help you know how much you can set aside to pay yourself first every month.

Figuring out what you can save may take some work, but it is worthwhile to work.

Take a look at these additional things to consider while reviewing your spending.

1. Cut Bills

Are there any bills that you can cut? Bills are usually static, but sometimes we can shop around for services like insurance and internet services to find ways to lower our bills. Or even refinance. Sure it costs a few grand, but the savings over a 30-year fixed mortgage is worth it.

2. Save on Food

Same with groceries and eating out. Look for ways to shop smarter and potentially cook more at home.

3. Delete Unnecessary Expenses

Are there any expenses that can be deleted? Review your spending for unused subscriptions or services you have signed up for and no longer need.

4. Are You Spending Too Much on Things You Want?

Review your hobbies and spending on things you want. Are you spending too much on things that are purely wants? Be honest with yourself. This type of spending may feel like you’re paying yourself, but really you’re paying others in exchange for things. Are those things intentional? Do all of those things bring you joy?

Setup an Automatic Payment for Yourself

Once you’ve determined how much you can safely pay yourself first every month without fear of missing a bill, it’s time to automate the system. You can set up an automatic payment to yourself in a couple of ways.

Automatic Bank Draft

The easiest way is by creating an automatic transfer amount from your checking to your savings. Every bank is slightly different, so if you have trouble, be sure to contact your banker.

My husband said this method helped him start to save while he was in college and trying to pay off debt. He started with $20 a week and when he didn’t even notice it at all, he bumped it up to $40, and eventually $70 a week.

This is the best way to start paying yourself first. Mainly because you won’t even notice after you set it. Also, the clear line of separation between your checking and savings account makes keeping track of things much easier.

Savings Direct Deposit

The other way to get your savings account growing automatically is to allocate an amount of your direct deposit to your savings account. This takes a little more work, though since you’ll likely have to get HR and Accounting to adjust your payment method.

How Much Should You Pay Yourself First?

You can start small with 5% or 10% or you put 20% aside, which is a common budgeting standard.

50/30/20 Budget

20% of your take-home pay is a solid goal. This number is based on one of the most common blanket budgeting systems out there. The 50/20/30 budget says 50% of your take-home (after-tax income) should be used for things you need, 30% for things you want, and 20% for savings.

- Example: $3,000 a month of take-home pay is $2,000 for needs, $1,200 for wants, and $800 for savings.

Check out this simple budget calculator to determine your 20% number right now.

Custom Budget: Play with the Ratios: 50/20/30, 60/15/25

The other line of thought is to assess how much of your take-home paycheck is left after your needs are met and play with the ratios of wants and savings allocations.

For instance, maybe you live in an expensive area and your needs cost close to 65% or more of your take-home pay. As a result, your wants may be 25% of your income and your savings might be 10%.

But say you don’t think you need 30% for wants. That number is pretty high after all. Allocate 15% to wants instead, so you can increase your savings.

- Example: $4,000 a month in take-home pay is $2,600 for needs, $600 for wants, and $800 for savings.

The goal of these blanket percentage budgets is to separate money into 3 main categories.

This avoids splitting your income into wants and needs and the tendency to see what’s left in your account after bills and see it as all spending money.

Paying Yourself First with Debt

Paying off debt can make it feel impossible to pay yourself first. While it is important to focus on paying down debts, especially high-interest debts like credit card bills and car notes, it is also important to build up a small emergency fund.

In the 65/15/25 budget example, split the 25% of savings towards savings and paying down debt, 15% to debt, and 10% to savings. Setting up an automatic draft to a savings account that is even $10 a week will grow over time.

Your Money Should Serve, You Not the Other Way Around

Money is a tool. It should serve you and make your life better, not the other way around. You should not serve money or be a slave to it.

The concept of paying yourself first is a new mental framework through which to view savings. It is a way to highlight the needs of your future self to yourself. If you spend all you have now and don’t work to pay yourself in the form of savings, it is like stealing from your stability and financial well-being later on in life.